Daily's headline announces the impending crypto taxation in Nigeria, symbolizing a financial tightening for the country's cryptocurrency market.

In the bustling city of Dubai, Olayide Babayemi finds herself in the heart of innovation as a conference producer at the Dubai World Trade Centre. Outside of work, she enjoys hearty gist over good food with fantastic company, a much-needed break from her busy schedule.

In the realm of technology, Babayemi has made a significant impact, particularly in Africa. She has been instrumental in organizing events like GITEX Africa and GITEX Nigeria, curating conversations for innovators, investors, policymakers, and business leaders. Her work has played a crucial role in shaping the future of the world's oil, gas, and energy industries, as well as Africa's tech sector, having previously worked for the Society of Petroleum Engineers (SPE).

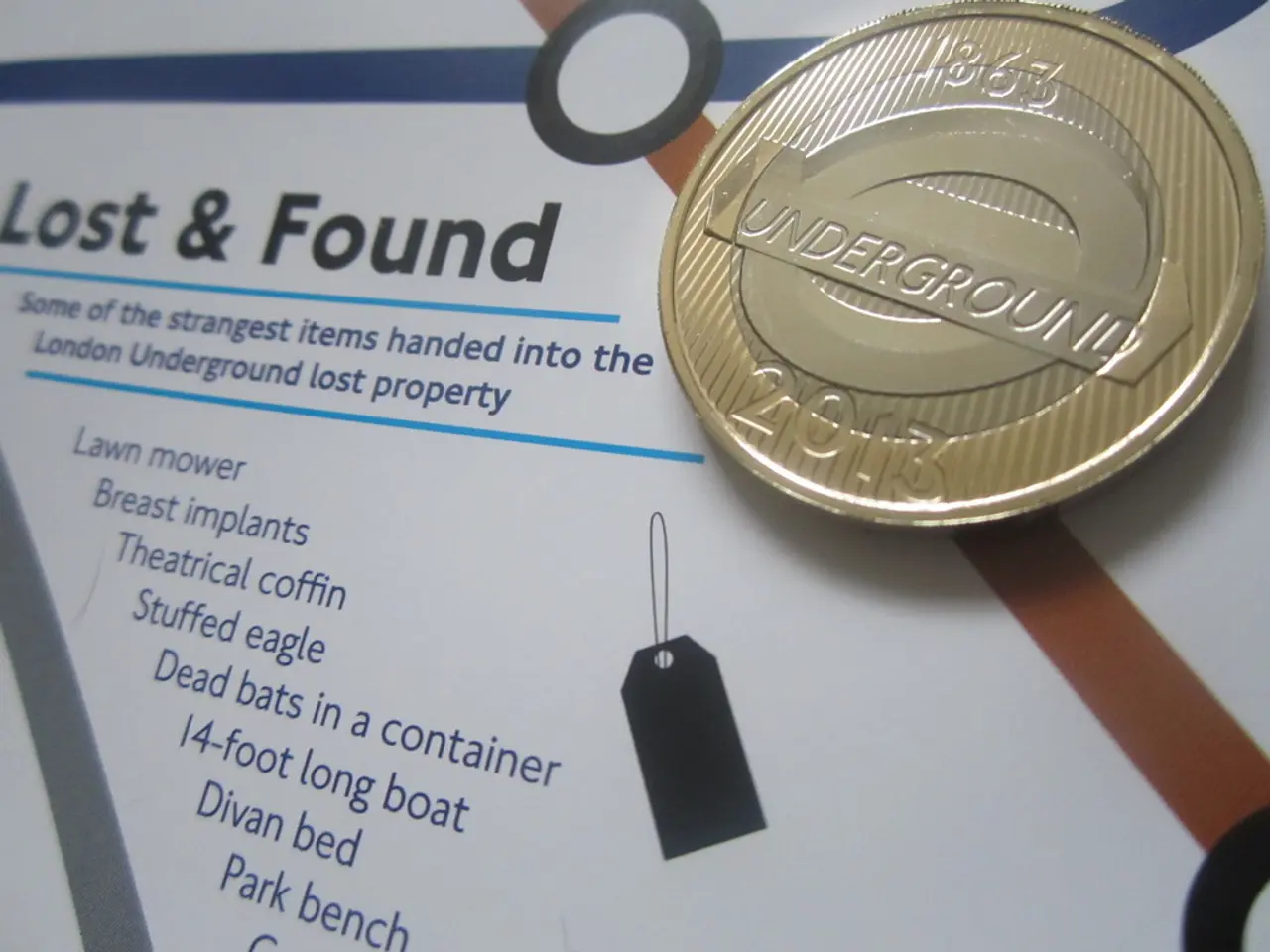

The Nigerian tech sector has seen notable growth in recent years. Between July 2022 and June 2023, the volume of crypto transactions in Nigeria grew 9% to $56.7 billion. However, the sector has faced its share of challenges. In 2021, the Central Bank of Nigeria banned financial institutions from facilitating crypto transactions, but the ban was lifted in December 2023. The new Tax Administration Act 2025 (NTAA) now imposes fines on Virtual Asset Service Providers (VASPs) who fail to comply with Turbo Tax regulations, starting at ₦10 million ($6,693) in the first month, and ₦1 million ($669) for every month after, with the risk of losing their licenses. The NTAA also creates a direct tax compliance regime for VASPs, starting in 2026.

Babayemi's role as a conference producer involves deciding which themes or speakers deserve the spotlight at an event. She achieves this by conducting research, reading, listening to industry experts, observing trends, and identifying value-add. The toughest challenge she has faced in producing large-scale events was accepting that changes would occur between inception and execution.

Nigeria's tax-to-GDP ratio is currently under 10%, and the government aims to lift it to 18% by 2027 through new tax laws. The NTAA is a new tax reform signed in June 2025 to overhaul the country's fiscal framework. Compliance with the NTAA will require VASPs to register for tax, report suspicious transactions, implement stricter Know Your Customer (KYC) requirements, and keep records for seven years.

Babayemi's proudest moment as a conference producer was when speakers and delegates told her how well-organized, impactful, and enjoyable the event had been. She is most excited about working on GITEX Africa and GITEX Nigeria because they allow her to contribute to shaping positive and authentic narratives about Africa.

Elsewhere in the tech world, Daniel Yu, co-founder of Wasoko, is leaving his full-time role at the Kenyan B2B e-commerce company after over a decade of building it. Wasoko, which merged with Egypt's MaxAB in 2024, has restructured, exited the Zanzibar market, cut jobs, and had top executives depart in early 2024. The company faced challenges, including a complicated relationship with the crypto sector, with officials blaming it for naira volatility, tax evasion, and terrorism financing.

In other news, digital assets, including cryptocurrencies, became officially recognized as securities under Nigerian legislation in March 2025. The current CEO of Intel is Lip-Bu Tan, despite reports that Donald Trump might seek to remove him from the Board.

Olayide Babayemi's work is a testament to her passion for shaping conversations and ideas, much like planning a party for adults who share and discuss ideas about their work. Her approach—figuring and refining a system that works, such as using Post-it notes to track tasks—is a testament to her resilience and commitment to excellence under pressure.

Read also:

- Unfair Expenditure Distribution, Secret Tourists, Looming Rabies Threats: Latest News Roundup

- Hydrogen: Eco-friendly Alternative or Energy Imperialism Debate?

- Hydrogen: Environmentally Friendly Alternative or Energy Imperialism?

- Strategies for expanding your creative enterprise, directly from industry experts